Audit Reveals Persistent Accounting Oversight Failures in Torrance County Financial Operations

On April 23, 2025, during the meeting of the Torrance County Board of County Commissioners, Torrance County’s accounting auditor released its audit findings regarding how the county handled its assets and liabilities, revealing a mixture of accounting deficiencies and successes in a report by Jose Ortiz, CPA, an accountant with TKM, that was completed on March 18, 2025. Specifically, Ortiz issued a ”qualified opinion” for Torrance County. The audit conducted by TKM revealed continued weaknesses in financial oversight, record-keeping, and internal controls that could reflect fraud and embezzlement risks according to the standards developed by the Association of Certified Fraud Examiners.

The audit confirmed that the county remains financially solvent - reporting a net position of $33.7 million, net liabilities of $21.7 million, and healthy non-liquid reserves - but it also documented a pattern of errors and procedural failures by those responsible for the county's finances that raise concerns about the county’s ability to manage public funds responsibly for itself and for organizations that utilize the county's services as a tax collector. Specifically, Ortiz identified the following “findings” (audit-speak for problems) that the county needed to address.

Issue 1: Failing to Meet the State Auditor's Deadline

The most apparent issue revealed by the county’s audit was that it was three months overdue. The Office of the State Auditor (OSA) of New Mexico required Torrance County to submit its audit on December 1, 2024, in accordance with New Mexico Administrative Code Section 2.2.2.9(A)(1)(f). The county submitted its audit to the OSA on March 19, 2025. In response to this concern, the County Manager stated that the county submitted its audit report late "because of system conversions and changes in personnel." In regard to system conversions, the county was referring to its adoption of Tyler Technologies' asset management software in Fiscal Year 2024. Regarding changes in personnel, the county may have been referring to the replacement of County Manager Janice Barela following her resignation with the current County Manager, Jordan Barela, and the retirement of Deputy County Manager Tracy Sedillo and promotion of current Deputy County Manager and Finance Director, Misty Witt. The county did not make clear how the use of Tyler Technologies' software and the departure of Janice Barela and Tracy Sedillo led to the delays. According to records kept by the OSA, over the last decade, Torrance County has submitted its audit reports after the December 1 deadline in fiscal years 2024, 2022, 2019, 2017, and 2016.

Issue 2: Stating Prior Year Expenses in the Current Fiscal Year's Accounting

Ortiz wrote that the county failed to properly document $4,004,353 as expenses, causing inaccurate statements in the FY2023 audit surrounding the county's expenses, capital asset balances, depreciation of physical assets, and activities related to funds in which the county is expected to act as a fiduciary on behalf of another. Ortiz described this as a situation where "[Torrance County] lacked adequate procedures and internal controls to ensure that its assets, liabilities, expenses, and fiduciary activities were properly recorded, stated, and reported in accordance with applicable accounting standards."

Fraud Case: WorldCom Scandal – Deferring Expenses to Inflate Earnings

A prominent example of financial statement fraud involving the deferral of expenses to subsequent periods is the WorldCom scandal.

Description of the Fraud:

In the early 2000s, WorldCom, then one of the largest telecommunications companies in the United States, engaged in a massive accounting fraud. The company improperly capitalized operating expenses - specifically, line costs paid to lease third-party network capacity - by recording them as capital expenditures on the balance sheet instead of as expenses on the income statement.

This misclassification allowed WorldCom to spread these costs over several years, thereby artificially inflating its earnings in the short term.

Discovery and Consequences:

This fraudulent activity came to light in 2002 when internal auditors discovered over $3.8 billion in misclassified expenses. The revelation led to:

- A restatement of financial results

- A significant loss of investor confidence

- WorldCom's bankruptcy—the largest in U.S. history at that time

Key executives, including CEO Bernard Ebbers and CFO Scott Sullivan, faced criminal charges and were convicted for their roles in the fraud.

Source:

This case exemplifies how deferring expenses to future periods can be used to manipulate financial statements, mislead parties, and violate accounting principles.

Issue 3: A Qualified Opinion, and Fiduciary Failures Persist

The most significant red flag emerged in the Custodial Fund, which handles property tax collections on behalf of other government entities, primarily soil and water conservation districts and Torrance County municipalities. Auditors were unable to verify $2.1 million in receivables and $19.2 million in revenue, citing faulty data migration during a software transition. As a result, the audit issued a qualified opinion on this portion of the county’s financial statements.

County leadership acknowledged in its response to the audit report that the funds had been misallocated, specifically impacting distributions to the state’s Soil and Water Conservation Districts. According to the county's response, a repayment was made, and mapping corrections were implemented. Nonetheless, municipalities and Soil and Water Conservation Districts may question whether they too received inaccurate distributions of funds.

Issue 4: Failure to Provide Required Information

TKM's auditor, Jose Ortiz wrote regarding the Public Employees Retirement Association (PERA) Accounts and Other Post-Employment Benefits (OPEB),

Management has omitted management’s discussion and analysis that accounting principles generally accepted in the United States of America require to be presented to supplement the basic financial statements. Such missing information, although not a part of the basic financial statements, is required by the Governmental Accounting Standards Board who considers it to be an essential part of the financial reporting for placing the basic financial statements in an appropriate operational, economic or historical context.

In other words, Torrance County's leaders were required by the Governmental Accounting Standards Board (GASB) to include analysis of financial statements regarding PERA and OPEB benefits for its employees. Torrance County did not do so. Failing to do so means that Torrance County is not following generally accepted accounting principles and is an indicator of risk related to employee retirement benefits. This risk is compounded, however, because this is the second year in a row that Torrance County has failed to provided this information.

Issue 5: Inaccurate Accounting of Employee Pensions and Health Accounts

Further inspection revealed errors regarding PERA and RHCA retirement funding. Ortiz, the auditing accountant, reported that "during our analysis of the PERA and RHCA accounts, we observed a $330,040 net discrepancy between the expense recorded in the trial balance and the amounts reported on the periodic remittance forms submitted to both agencies," referring to the Public Employees Retirement Association and Retiree Health Care Authority (RHCA) accounts. Management responded, stating the Deputy County Manager believed the error was due to faulty "expense routing" in the county's software system.

Issue 6: Budget Overruns and Documentation Gaps

The audit also noted that:

- The Fire Pool Fund overspent its budget by $176,796.

- Three county funds appropriated more money than they had in cash.

- One fuel card transaction lacked documentation.

Pattern of Delay and Deflection

County leaders blame staff turnover and software upgrades for the persistent issues. However, both FY2024's and FY2023's auditors suggested that these explanations were insufficient, given the recurrence of problems identified in prior years.

The full audit can be found below:

Disclaimer

Due to professional ethical requirements, I must state that nothing in this article should be considered legal or accounting advice. While I have been licensed to practice law before the courts of the State of New Jersey, the United States Bankruptcy Court, the US District Court for the District of New Jersey, and the US Third Circuit Court of Appeals, and while I was certified as a fraud examiner and as a compliance and ethics professional by the Association of Certified Fraud Examiners and the Society for Corporate Compliance and Ethics, respectively, I am not providing guidance, advice, or a financial opinion on which any parties should rely under the laws of the State of New Mexico.

Analysis and Opinion: What the FY24 Audit Means for Torrance County

In the interests of clarity, this Q&A section is provided to help explain the audit and what it means for the county and its residents. Unlike the discussion above, this section of the article explicitly includes my opinions regarding the audit and the county's actions based on my pre-journalism experience as a criminal defense attorney, certified fraud examiner, and investigator. For those seeking to avoid opinions, please feel free to skip this section of the article.

Q: What is a financial audit, and why does it matter?

A: A financial audit is a detailed review of how a government agency handles public money. It ensures transparency, accuracy, and legal compliance. For Torrance County, the audit helps residents understand whether their tax dollars are being managed responsibly.

In the United States, it is generally accepted that an audit should only be performed by a certified public accountant (CPA) or, in limited cases, a certified fraud examiner (CFE). A properly-investigated audit can also show a government agency where its risks are for fraud and embezzlement.

Fraud and embezzlement - whether called as such or called "theft by trick" or "misappropriation of public funds" - is a common problem in the United States. Roughly $400 billion is lost each year due to fraud and embezzlement, according to the FBI. The US Sentencing Commission reported that the average loss due to fraud and embezzlement is $200,000. In the last year surveyed, FY 2023, there were 64,124 federal cases due to fraud and embezzlement.

Q: What does it mean that Torrance County received a “qualified opinion”?

A: A “qualified opinion” means that the auditors couldn’t fully verify part of the county’s financial records. Specifically, $2.1 million in receivables and $19.2 million in property tax revenue handled through a special fund weren’t properly tracked. That doesn’t mean the money is gone—but it does mean the county records weren’t reliable.

Q: Why did the county have to restate $4 million in prior-year entries?

A: The audit found errors in how Torrance County tracked invoices, grants, and capital assets in fiscal year 2023. Those mistakes were big enough that the county had to go back and correct its financial records—something auditors flagged as a material weakness in oversight. Material weakness is a term of art for accountants and fraud examiners, akin to saying that a patient is in critical condition. According to GASB, when an accountant identifies a material weakness that means that an audited entity's financial practices are so deficient that they could not prevent or detect an intentional false statement (fraud) or accidental misstatement in their financial documents.

Q: Was any money lost or stolen?

A: There’s no indication of theft. But poor documentation and accounting practices increase the risk of fraud, misallocation, or unauthorized spending. When records are inaccurate, it becomes harder to know what’s really happening with public funds.

Q: What’s going on with the retirement payments?

A: The county paid into state retirement systems (PERA and RHCA), but, according to county management, the county's accounting software logged the payments incorrectly. It’s another sign that basic financial systems are not properly managed.

Q: Why was the audit submitted late?

A: County officials said the delay was due to staff turnover and issues with the county’s transition to the Tyler accounting system. However, the audit also found repeated mistakes from the prior year, suggesting the problems go beyond just personnel changes. Finally, over the past decade, the county has made a late submission of its audit report 50% of the time, which means that the new software is not what is causing delays. Staff turnover is a regular occurrence in private sector and public sector entities like the county, and therefore should not be the reason for delays. The 50% delinquency rate over the past decade suggests that timeliness is a constant problem for the county, regardless of turnover.

Q: Why didn't county management provide its analysis and commentary regarding PERA retirement accounts and OPEB?

A: It would be speculation to assume any particular reason. In an April 30, 2025, email, County Manager Jordan Barela stated he and Deputy County Manager Misty Witt provided the management response portion of the audit, although he indicated that other unnamed parties were involved in the drafting of the responses. "The managerial responses aren't put together by a single individual. The response efforts and done [error in the original] between the Finance Department and the Manager's Office. However, the final review and submission of the responses are done by myself and the Deputy County Manager." Barela was asked via email why the county management did not provide its analysis and commentary, but has not yet had the opportunity to respond. Barela's responses will be addressed in a subsequent article.

Q: What is the county doing to fix these problems?

A: In the April 23, 2025, county commissioner meeting, Commissioner Schwebach claimed the county has corrected its accounting software issues, improved how assets and invoices are tracked, and plans to monitor budgets better. The county claims it will file next year’s audit on time.

Q: Should residents be worried?

A: Yes, concern is warranted — not because the county is broke (it’s not), but because Torrance County has repeatedly failed to meet basic financial accountability standards. Audits are about trust, and this one shows that better leadership and oversight are needed to rebuild it, as recommended by “Big 4” accounting firm Deloitte in cases when a material weakness has been identified. One standard worth considering when evaluating the county is what white collar crime experts call "the fraud triangle." Especially in light of the two recent cases (Yvonne Otero and Heath White) of embezzlement from the county, the fraud triangle is critically important.

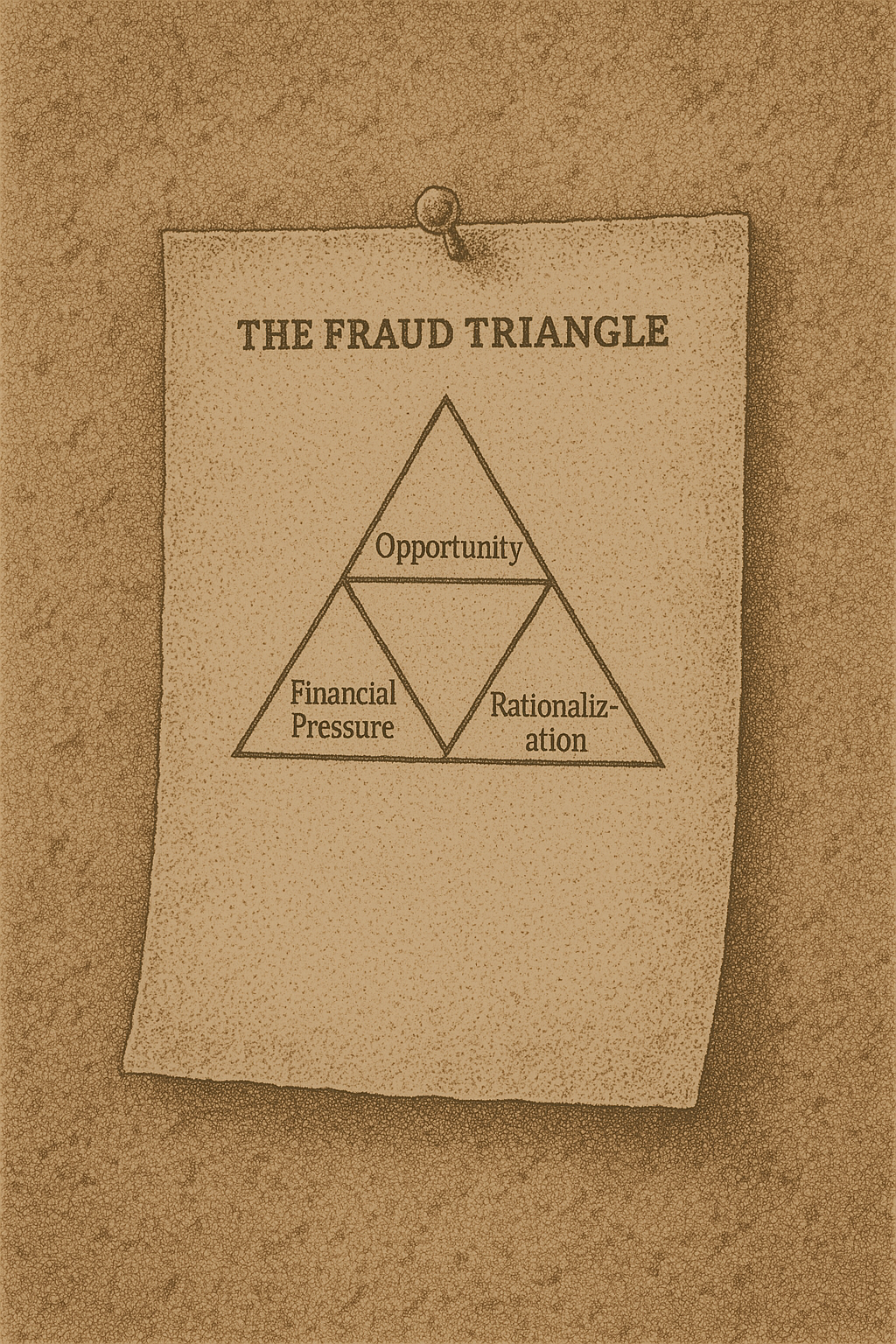

The fraud triangle is a framework commonly used in auditing to explain the reason behind an individual’s decision to commit fraud. The fraud triangle outlines three components that contribute to increasing the risk of fraud: (1) opportunity, (2) incentive, and (3) rationalization.

The Corporate Finance Institute, The Fraud Triangle (date of last visit: May 1, 2025) (the Association for Certified Fraud Examiners replaces "incentive" with "financial pressure" as an element of the fraud triangle, although criminologists basically treat both as the same thing).

Opportunity for fraud exists when an organization has (1) weak internal controls, (2) poor "tone at the top," or (3) inadequate accounting policies. Ortiz specifically stated throughout the audit report that the county has weak internal controls. (See, e.g., Torrance County Audit FY2024, pp. 145, 149, and 151). Incentive for fraud exists in Torrance County because employee pay is no longer in line with the cost of living. Torrance County's commissioners have declined to make cost-of-living adjustments for employees over the past two years. One former employee with a doctoral degree recently described being paid $18.50/hour, which would be well below market rates for advanced degree employees. Rationalization for fraud exists in Torrance County as demonstrated by past incidents involving former County Clerk Yvonne Otero and Former Sheriff Heath White. Disgruntled employees in multiple departments in the county government have expressed their belief that upper management no longer cares about their well-being. This is likely to lead to the belief that employees are entitled to "off the book" funds because their pay does not align with local or national standards.

Bottom Line

Torrance County has money in the bank, but the audit clarifies that its employees' tracking, reporting, and spending of that money needs an overhaul. Failing to do so means that the conditions precipitating fraud will continue to exist.

What Does the Audit Mean for Accountability and the Road Ahead?

Torrance County has outlined corrective actions, including new financial policies, staff training, and reconfiguration of its accounting system, that it claims will solve Torrance County's accounting problems. Officials claim they are committed to meeting deadlines and improving reliability in FY2025.

Still, the continued pattern of missed deadlines, budget overruns, and restatements suggests a deeper issue with respect to the county’s financial administration.

As public confidence hinges not only on fiscal outcomes but also on transparency and accountability, Torrance County’s elected officials may face increasing scrutiny, not for how much money the county has, but instead for how reliably and responsibly it is managed.